What is Digital Risk Profile?

Traditional scoring models can now be supported by more information than ever.

Providing access to products and services for many unbanked customers can be a challenging issue that many CSPs face all too often. Many (although not all) of these customers have limited familiarity with formal financial services, which inhibits CSPs from making good decisions in regards to providing access to services and the appropriate credit control limits on top of subscribed services. RAID Cloud’s Digital Risk Profile unlocks the power of social data by making it possible to engage with millions of underserved consumers in a fast and accurate way. The solution allows CSPs to have access to innovative data on their consumers with limited or no formal credit history and who also choose to make their social profile data public and available to our Digital Risk Profile service.

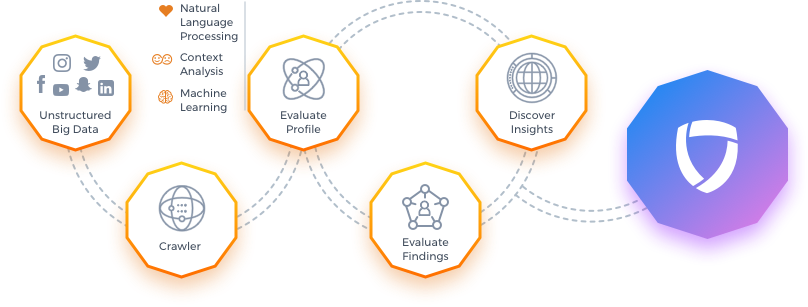

Digital Risk Profile delivers a significant impact on financial inclusion by supporting credit access to those consumers who previously had limited interaction with banks or financial institutions. Working in conjunction with credit bureaus whenever the information exists, RAID Cloud enriches this information with a suite of models based on social data for use in several customer centric approaches, from financial to marketing. RAID.Cloud relies on over 50 variables contained within existing online social accounts to generate a more holistic view of an individual or organization.

Trace the Digital Footprint

Gather all publicly information in a single view.

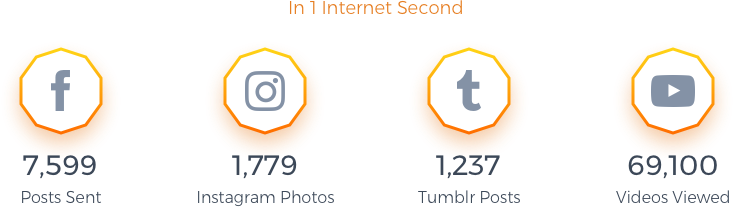

The growing quantity and complexity of digital data available offers the chance to harvest threatening data from the web, IRC channels, forums, paste sites, social media, and threat feeds. As organizations face more pressure than ever to discover how to do business safely and reliably in a world full of danger, they require all new strategies and technologies to combat the external threats while also being able to qualify who has access to their offer. But attempting to find and collate this information manually is as inefficient as it is cost intensive.

Social Media and Security Information

Enhance your cybersecurity tools integrating social media information

Digital Risk Profile application crawls the web in real-time to gather information, the main goal being to provide a subjective understanding of an entity (customer, partner, company...) represented as indicators related to behavior, activities, subscriptions and related content. Threat actors have moved beyond their traditional stomping grounds of web and email to exploit the riches of new digital territories, in particular, social media platforms, and organizations’ digital trails are typically larger and more complex than those of an individual. As modern organizations transact more business via digital channels on the internet, the number of web and mobile applications and social media profiles they use grows—and grows rapidly.

The integration of Digital Risk Profile’s collected information with line-of-business applications allow you to:

Assess your customer’s profile and map different sorts of behavior;

Discover compromised information;

Evaluate Third Party Vendor data based on online discussions;

Provide relevant information from customers to align go-to-market strategies and company offers;

Provide customers with information about data protection and leakage through conditional opt-in based rewards programs;

Digital Risk Profile

Unlock the power of social data to improve the ability to make fast and accurate decisions

SCHEDULE A DEMO TRY NOW FOR FREEUnlock the power of Social Media

Faster insights lead to smarter decision making

Make fast decisions;

Increase the adoption of premium products and services in the current customer base to increase ARPU;

Dramatically increase the speed and efficiency of due diligence processes;

Discover new and emerging market trends/threats;

Identify behavioral patterns which lead to negative impacts on your organization;

Learn about abnormal customer behaviors from those who actively manipulate their identities in the marketplace;

Improve identity verification, avoiding potential violations reducing churn processes;

Get up-to-the-minute individual information, before any binding acceptance;

Enhance your portfolio management through the ability to analyze customer patterns to reduce customer churn and enhance brand reputation;

Unify several data points, like Facebook, LinkedIn, twitter or YouTube for increased real-time threat intelligence.

Pull from everywhere, integrate everything

Digital Risk Profile puts all the valuable information in one intuitive dashboard.

Accessible through a REST API interface;

Seamless integration with other valuable third party data sources to further enhance the predictability of the provided information;

Prebuilt Machine-learning models with the ability to evolve on their own;

Creation of hotlists for every provided indicator;

Ability to tag users according to developed templates through data analysis utilizing machine learning, natural language analysis algorithms and correlation tests;

Customizable models to meet business threats tolerance levels;

Real-time monitoring and automatic case opening based on sentiment analysis and similarity to abnormal identified profiles.

RAID.Cloud Everywhere

Get powerful understanding of your subscribers to optimize your business.

Generate powerful insights into the decision-making behavior of unbanked consumers;

RAID.Cloud can also help accelerate deployment time as well as reduce the ongoing costs associated with managing a traditional on-premise application;

Get insights into a customer’s propensity to say “yes” to an offer as well as their willingness and ability to pay for the services;

Accessible through a REST API interface;