How PrePaid Fraud impacts your revenues?

Protect your business from prepaid account manipulation stopping fraudsters from illegally modifying account balances and account types

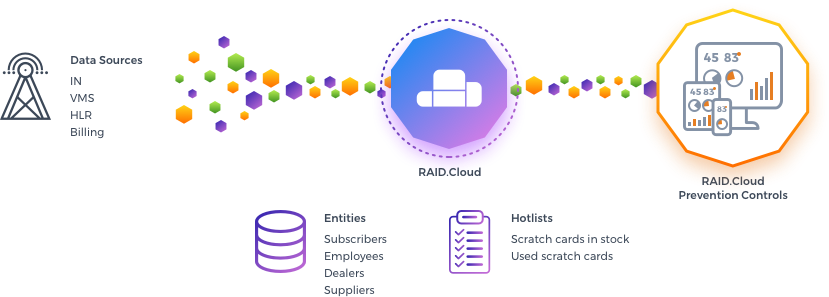

Prepaid fraud can have an huge impact in operators with a large prepaid subscribers base due to the multiple actors that can be involved in those fraud scenarios, customers, employees, dealers and suppliers.This type of frauds often occurs from technical errors or system manipulation: IN, Voucher Management Systems (VMS), HLR, Billing among others..

These type of frauds can be perpetrated in several ways, the most common are:

Recharge Vouchers(Top Up), usually stolen scratch cards or generated by internal resources that have access to the Top Up system (VMS) to be sold in the market to potential subscribers with no payment to the telecom operator

Manual Recharges made internally to credit a subscriber account without performing any payment related to that credit

Modification of Recharge Voucher Status/Value by re-activating the voucher internally in order to be reused

Guessing Voucher Numbers by trying to guess valid voucher numbers, by brute force attacks or taking advantage of the poor algorithms used to generate the keys

Airtime transfers to inactive subscribers or transfer amounts that are out of the standard patterns

Using the gap of delay in accounting the traffic while in roaming to use services that has no intention to pay for the calls

Account rate plan changes (prepaid to postpaid, the opposite or too many rate plans changes) to take advantage of the system inconsistencies avoiding paying the traffic

Account Balance update by direct manipulation to inflate positive or incorrect balance adjustments

Abnormal Account Balance, keep a negative balance but still using the services or balance too high

Pre-paid flag in billing system are not set causing a pre-paid costumer to be considered a post-paid which cannot be billed by any usage

How is PrePaid Fraud detected?

Cross referencing information from multiple actors provides the best insights

RAID.Cloud PrePaid Fraud App, is an already pre-configured Fraud Management Application, which allows you to audit and control five distinct criteria:

High Usage Recharges

Audit all the recharges to identify and alarm the scenarios where the number of recharges, repeated recharges or the amount are greater than a define threshold.

Scratch Cards Abuse

Audit all the recharges based in scratch cards to identify and alarm the scenarios where are used fake PIN numbers, cards that were not yet sold in the market or recharges that were already used in another account.;

Airtime Transfer

Audit all the credit amount transferred between subscribers to identify and alarm the scenarios where there the amount transferred is greater than a define threshold or where the amounts are transferred to inactive subscribers;

Abnormal Account Balance

Audit all the account transactions to identify and alert abnormal account transactions, inflation of credits or bonus , that are greater than a defined threshold.

Abnormal Account Migration

Audit the changes in the account to identify and alert changes from postpaid to prepaid and the opposite, as well multiple rate plans changes greater than a defined threshold

Real-time insights into suspicious activities

Monitoring the behavior of customers, employees, dealers and suppliers mitigates revenue loss and identifies the source

The Prepaid application contains several engines and for each engine different rules that will be used to identify possible fraud behaviors perpetrated by the subscribers or internal operator employees

Each audit entity, in this offer Subscribers and Vouchers, will be classified according a segmentation structure defined in the solution. The segmentation determines the logical division of the entities into segments that may be used in detection or correlation in order to create more accurate rules focus in each segment level and value

A set of Detection engines will run aggregating and evaluating the prepaid rules defined by the Fraud Analyst. Once the prepaid rules thresholds defined are reached, alerts will be raised. The data aggregation will be done per actor (MSISDN and Scratch Card) according the segmentation and events considered. The data aggregation timeframe that will be used to accumulate the relevant events is One Day, a Week and Peak/Offpeak in certain engines

Improve business efficiency and increase revenues

Identify and thwart internal and external fraud attempts

Protects your revenues and company reputation delivering a competitive advantage through the detection of frauds allowing you to take the proper action to solve it;

Shorter time to market, register and start;

Increases revenue by unveiling fraudulent operations internally and externally;

Secures the correct operation and management of prepaid accounts

Subscribe one or more apps and built your customized Fraud Management solution according to your needs and budget.

Secure your PrePaid business operations

Use RAID.Cloud to stop the fraudulent manipulation of subscribers prepaid accounts

Next-generation services configured out-of-the-box to provide full coverage of Roaming Fraud;

Several ingestion methods available: manual upload,, secure FTP on RAID.Cloud and CIF mount point for inbound and outbound traffic;

Alarm management with a graphical dashboard and insightful email notifications, allows you to take instant awareness of all possible fraud types and behaviors with recommended mitigation.

Detailed alarm status provides to the fraud analysts the ability to perceive the scope of the alarm, but also to mark them if analyzed, helping them to manage their workload.

Detection engines that continually evolve based on the latest fraud trends;

Built-in Hotlist of know fraud numbers and countries provided according to GSMA recommendations;

Allows you to add records in Scratch cards in stock and used, Subscribers and Dealers hotlists;

Whitelist of known customers with abnormal behavior already identified as non-fraudulent to skip the detection engines and reduce false-positives;

Control rules thresholds with near real-time alerts associated;

Network subscriber classification according to: activation date, type of market, customer risk and contract type;

Audit fraud behaviors related with manual recharges, abusive credits, scratch card abuse and profile manipulation.